Short selling:

An investor who sells stock short borrows shares from a brokerage house and sells them to another buyer. Proceeds from the sale go into the shorter's account. He must buy those shares back (cover) at some point in time and return them to the lender.

I question the validity of being able to short a stock. Unfortunately for stockholders, shorting a stock has the result of increasing the amount of shares that are available for sale.

A result of short sales is an increase in the supply of shares available to be sold at every price level and reducing the pressure on the stock price to rise in order to meet a demand for the shares, even if all the stockholders have no intention of selling, since others are willing to take your shares and sell them (for you.) It is almost if the system is stacked to the side of selling.

Of course shorting a stock can backfire on the short seller. If a stock has a high ‘short interest’ and the days to cover is high, then the stock might be at risk for a Short squeeze. As the price of the stock rises, an increasing number of shares that were short are being bought back in order for the short sellers to cover and close their positions, pushing the share price higher. After all, increasing stock prices result in increasing losses for stock shorters. However, all the time that the stock is rising, others are busy attempting to short it with the expectation that the price rise is only temporary.

You might ask why would a stockholder agree to loaning their shares to another person who is going to turn around and sell them? Sounds pretty counter productive right? It’s not like your getting reimbursed by the trader who’s going to borrow your shares and sell them. Not only do you agree to loan your shares, but you also agree to give up any dividend the stock pays. You still get the amount you would have received as a dividend. However, the money is paid by the person who borrowed your shares, and it is not considered a dividend. It is “in-lieu” income. The person who purchased your borrowed shares receives the dividend. No difference right? Wrong. Dividend income is taxed currently at 15%. In-lieu income is taxed as regular income. After all, the company pays each share a dividend once and the dividend goes to the ultimate holder of the share. So holding dividend paying stocks in a margin account might actually affect you negatively. Of course you can afford more shares if you purchase them on margin, so you might come out ahead anyway. (More on margin accounts in this POST.)

Do you think that you are not loaning your shares out to a short seller? As it so happens, you agree to loan your shares to your broker for shorting when you open a margin account. So if you have stock in a margin account, chances are that your broker is looking at them as a potential source of shares to make a short sale.

Let’s say that none of the stockholders is interested in selling the stock, but the broker has a client (if not himself) who is just dying to short it. Which brings us to the practice/abuse of ‘naked shorting.’

Naked shorting is when a stock is sold short but the ‘borrowed share’ is never delivered three days later at settlement time. Essentially, the broker sold the share without ever buying or borrowing it.

In the U.S., in order to sell stocks short, the seller must arrange for a broker-dealer to confirm that it is able to make delivery of the shorted securities. This is referred to as a "locate", and it is a legal requirement that U.S. regulated broker-dealers not permit their customers to short securities without first obtaining a locate. Brokers have a variety of means to borrow stocks in order to facilitate locates and make good delivery of the shorted security. The vast majority of stocks borrowed by U.S. brokers come from loans made by the leading custody banks and fund management companies (see list below). Sometimes, brokers are able to borrow stocks from their customers who own "long" positions. In these cases, if the customer has fully paid for the long position, the broker can not borrow the security without the express permission of the customer, and the broker must provide the customer with collateral and pay a fee to the customer. In cases where the customer has not fully paid for the long position (meaning, the customer borrowed money from the broker in order to finance the purchase of the security), the broker will not need to inform the customer that the long position is being used to effect delivery of another client's short sale. - Wikipedia

Question 4.1: How should broker-dealers determine “reasonableness” to satisfy the locate requirement of Regulation SHO?

Answer: Rule 203(b)(1)(ii) permits a broker or dealer to accept a short sale order in an equity security if the broker-dealer has reasonable grounds to believe that the security can be borrowed so that it can be delivered on the settlement date. “Reasonableness” is determined based on the facts and circumstances of the particular transaction. What is reasonable in one context may not be reasonable in another context. The Commission provided some examples of reasonableness in the Adopting Release. (69 FR at 48014 and Footnotes 58, 61 and 62).

Think these cases of failure to deliver are isolated incidents? Guess again. The exchange has to maintain a list of the stocks that have a high rate of ‘failure to deliver’ at settlement date. As of 4 April, Nasdaq had 218 stocks with a high ‘failure to Deliver’. Look at the current list here. Not surprisingly, our friend Overstock.com is on this list. The joke is, it has been on this list for a long while

As you can imagine, Overstock is not too please about this situation. Who would be happy about someone selling fake shares in their company. They however are trying to do something about it, and have filed suit. Take this point from their site:

How do you know failures to deliver are occurring and that Overstock's stock is being naked shorted?

Both the NYSE and NASDAQ say that it is. The SEC now requires the NYSE and NASDAQ to publish a list, updated daily, of companies whose stocks have unusually high volumes of trades that fail to deliver. The list is called the Reg SHO Threshold list, and under Reg SHO, no company should be on the list for more than 13 days: Overstock has been on the list for more than 200 days.

NASDAQ Reg SHO Threshold Security List.

NYSE Reg SHO Threshold Security List.

There are other indications as well. Recently, Overstock's president, Patrick Byrne, and its Chairman, Jack Byrne, each purchased several thousand shares of Overstock, but their brokers could not settle the trades over several weeks.

How big of a problem is naked short selling?

We don't know - the SEC, NASDAQ, and the DTCC all refuse to disclose the daily volume of failures to delver in Overstock's stock, or in the overall market. We know Overstock has sold just over 19 million shares to the world, but that the world seems to own between 35 to 40 million shares of Overstock. The SEC has also acknowledged that there are at least $6 billion worth of failed trades in U.S. capital markets every day.

Part of the problem here is surely due to a culture issue of Wall Street ‘Professional’ insiders. There is even some idiotic notion that naked shorting is a good thing. That this activity somehow fulfills a demand for the stock. What a load of bull.

If there is demand for the stock and not enough available shares, then the price of the stock will go up until enough shares become available to meet the demand or the demand drops. That is the very basis of how a market works. Supply and demand is a very simple concept. The problem here is that we are not dealing with physical items being traded. We are trading electronically. Imagine trading baseball cards, but you left yours at home. How successful can you be at a show promising to delivers the cards that you have left at home. Not very likely as people would demand immediate delivery. Claiming that you owned the cards but left them home would do nothing to prevent others from thinking that your are attempting to scam them. In the case of the stock market, your account merely shows that you own the stock. It might be another matter entirely if you request a stock certificate for the shares that you bought. In that case, they would need to have the actual shares in-hand.

As far as I am concerned, if you want to sell something that people want to buy, then you should first own it, or at a minimum, first have possession of it, in the case of shorting.

Those who defend shorting say that it is a way for people to profit from companies whose stock is overvalued. The determination of whether a stock is overvalued or not is often a subjective one. It is funny for an outsider to tell those that own a stock that it is overvalued. It must surely be a criminal act for a broker to short a stock in anticipation of one of their analyst’s pronouncement that a stock is overvalued. The price of an overvalued stock will in time correct itself, even without the ‘assistance’ of short sellers. Once again, this is how markets work. If for some reason, those who own the stock fail to lower their selling price from overvalued levels, then that is what the company is worth to those who own it. As long as the amount available for sale has an equal amount of demand, then the price will hold. Otherwise the unsold shares will bring down the price, if the goal is to sell them.

Shorting moderates any rise on the stock, hurting the stockholders. The stockholders are the owners of the corporation Naked shorting not only hurts the existing stockholder but also hurts those buying the stock, with the exception of those who are covering short positions, especially when there is a ‘short squeeze’ as the additional shares offered by a naked short seller will moderate the rise of the price of the stock through the increase of the supply. After all, there is no restriction on the shorting of a stock when the price is rising, other than locating the shares first, and a naked shorter is not bothering to do that. He has a more pressing problem, to cover existing short positions.

One huge problem with shorting is that there is no way to tell how much of a particular stock is sold short. Again, in the age of the electronic exchange, there is no reason that we should not have access to daily if not live statistics on just how many shares are sold short and just which brokers are selling shares short and just how much they have sold short compared to how many shares they have possession of. They should also be required to document the exact shares that they are going to surrender at the time of settlement. Even better would be the banning of selling borrowed shares. As mentioned above, they should first have possession of the shares they intend to short. If for some reason a stock appreciates, the firm’s brokers should not be able to short unless they have the shares in-hand.

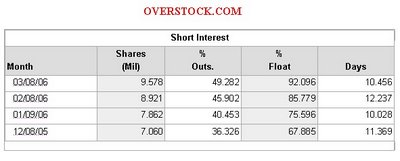

Overstock.com has issued about 19 million shares of stock. The latest short interest figures from the stock market have about 9.5 million shares short, about 49% of the total. This number is even more impressive when you figure that not all 19 million shares are available for shorting. According to Overstock, there are only 8,970,394 (10 March) registered in the electronic exchange, so that would be the theoretical maximum available to short. The reminder of Overstocks stock either has been issued as paper certificates, and not eligible for shorting unless a broker borrows them and adds them into the electronic register, or the shares have not been issued in any form by the Company.

On the surface, it appears that a huge number of shares have been illegally added to the system, most likely by naked shorting. But I wonder, can a share be borrowed more than once? When a share is purchased, it makes no difference to the buyer if the share is shorted or not. (At least theoretically) In fact, the buyer cannot tell the difference. And in their case it makes no difference (ignoring the fail to deliver issue.) if they are shares from a long or short position. Once the trade has been settled, they are in possession of the shares. So, at that point, why can’t the broker borrow those shares if they are being held in a margin account? From what I can tell, there is nothing to prevent this, and in fact it is perfectly legal. To say no would indicate that there is a difference between those shares and shares that were sold short. If that is the case, then buyers should be able to select if they only want to purchase shares being sold ‘long.’

I find that the possibility of shares being borrowed multiple times outrageous. As long as people are purchasing the shares in margin accounts, the number of shares in the market can expand mush higher than the authorized issue size. Shorting is turning the stock market into a joke. Take this sad story:

On Feb. 3, a man named Robert Simpson filed a Schedule 13-D with the SEC describing his purchase of 1,158,209 shares of Global Links Corp. (OTCBB: GLKCE), "constituting 100 percent of the issued and outstanding common stock of the Issuer." As described in a story that ran on FinancialWire on March 4, Simpson stuck every single share of the company in his sock drawer -- and then watched as 60 million shares traded hands over the next two days.

In other words, every single outstanding share of the company somehow changed hands nearly 60 times in the course of two days, despite the fact that the company's entire float was located in Simpson's sock drawer. In fact, even as recently as last Friday, 930,872 shares of Global Links still traded hands. If Simpson's claim that he owns all shares is accurate, that is a staggering number of phantom shares being traded around by naked short sellers. – Motley Fool

First we have the brokers. They are the gate keepers of the system. Most of us who trade electronically via the web and never talk to a broker cannot do any of this. Sure we can short shares, but it is our broker who decides if they can find the shares for us to short. Taking into account the $6 billion in failure to delivers each day, this is clearly not being done.

Then we have the The Depository Trust & Clearing Corporation. (DTCC) They act as the Clearing and Settlement System, basically it is through them that your shares will most likely pass when you buy and sell. They selling broker presents the shares for the buying broker to collect. Since most of this is taking place electronically, it is merely a matter of making entries into the books of the transfer of the shares. I would think that they share a good bit of blame since they are the maintainer of the books, they can see exactly how big a problem there is and who is contributing to the problem. (which brokers are failing to deliver.)

One thing that I see, is that everyone just assumes that it is the shorting transaction that fails to deliver. What happens when the person whose shares have been shorted decides to sell them? It is the broker who needs to either require the borrower of the shares to replace them or to replace them with other borrowed shares. I wonder how big a problem it is in replacing the borrowed shares? When the shares are located for a shorter to borrow, the broker makes money. Replacing the borrowed shares is just work.

This is by no means meant to be a complete post on shorting. I suspect that this story will grow over the course of this year into a good-sized controversy.

--------------------

Note: This post mentions that brokers “might” do some nasty things to manipulate the market. Of course I did not mean you, after all, that would be illegal.

Overstock Short Interest Now 107% of Float on Deposit at DTCC – Overstock

Regulation SHO Threshold Security List - NASDAQ

Dividend Tax Breaks at Risk – Fool.com

2 comments:

Excellent explanations of the shorting problem today-of course you wrote this back in 2006 but it does look like they're finally looking at some of the problems therein. I found your blog totally by accident while searching for an explanation for a friend of the problems with margin accounts and shorting stock. Excellent work.

Post a Comment