The Wall Street consensus is that the practice of short selling is an accepted market strategy.

In finance, short selling or "shorting" is the practice of selling a financial instrument that the seller does not own at the time of the sale. Short selling is done with intent of later purchasing the financial instrument at a lower price. Short-sellers attempt to profit from an expected decline in the price of a financial instrument. Short selling or "going short" is contrasted with the more conventional practice of "going long" which occurs when an investment is purchased with the expectation that its price will rise.Typically, the short-seller will "borrow" or "rent" the securities to be sold, and later repurchase identical securities for return to the lender. If the security price falls as expected, the short-seller profits from having sold the borrowed securities for more than he later pays for them but if the security price rises, the short seller loses by having to pay more for them than the price at which he sold them. The practice is risky in that prices may rise indefinitely, even beyond the net worth of the short seller. The act of repurchasing is known as "closing" a position. Short Selling is often used in hedge funds. - Wikipedia

We all know this. But did you ever think that shares could be borrowed multiple times? Well they can.

Imagine a company that has ten shares of stock. I own five of the shares and you own five. Your shares are borrowed by a broker who then re-sells them. The end result, I own five shares, you own five shares, buyer ‘x’ owns five shares. That totals fifteen shares. Short Selling has the effect of increasing the total number of shares available for a corporation well above the total number of authorized shares. The way the professionals on Wall Street reason that this is OK is because somewhere there is shorter ‘y’ who owes those fives shares and is expected to buy them at some point in the future. (And yet, the market regulators only publish that number owed once a month instead of daily like other market trading statistics.)

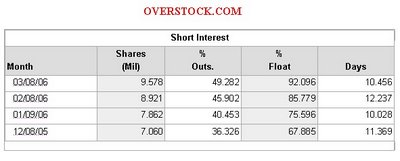

In this basic example above, the total number of shares available was increased by 50%. However, there are plenty of stocks with five and even ten percent of the stock ‘float’ shorted. That increases the number of shares available by millions. The only group that should have the right to increase the authorized share capital of a corporation are the owners themselves. Think 50% is an unrealistic number? Take my post from April, 2006 (Are Brokers 'Screwing' Stockholders through Short Selling?) which covered the extreme case of OVERSTOCK.com where :

In this basic example above, the total number of shares available was increased by 50%. However, there are plenty of stocks with five and even ten percent of the stock ‘float’ shorted. That increases the number of shares available by millions. The only group that should have the right to increase the authorized share capital of a corporation are the owners themselves. Think 50% is an unrealistic number? Take my post from April, 2006 (Are Brokers 'Screwing' Stockholders through Short Selling?) which covered the extreme case of OVERSTOCK.com where :

Overstock.com has issued about 19 million shares of stock. The latest short interest figures from the stock market have about 9.5 million shares short, about 49% of the total. This number is even more impressive when you figure that not all 19 million shares are available for shorting. According to Overstock, there are only 8,970,394 (10 March) registered in the electronic exchange, so that would be the theoretical maximum available to short. The reminder of Overstocks stock either has been issued as paper certificates, and not eligible for shorting unless a broker borrows them and adds them into the electronic register, or the shares have not been issued in any form by the Company.

Not very fair is it? Now this situation is with the shares being properly 'borrowed'. I question the validity of being able to borrow a stock to short it they way the market does it, especially considering that the accounts still show the stock as being held by the account even if the shares have been borrow. This would be like letting your friend borrow your car and it still being in your driveway despite the fact that he had driven it to work. (Or how about your car title being transfered to the person borrowing the car while you still have to pay car payments, insurance, etc.)

Not very fair is it? Now this situation is with the shares being properly 'borrowed'. I question the validity of being able to borrow a stock to short it they way the market does it, especially considering that the accounts still show the stock as being held by the account even if the shares have been borrow. This would be like letting your friend borrow your car and it still being in your driveway despite the fact that he had driven it to work. (Or how about your car title being transfered to the person borrowing the car while you still have to pay car payments, insurance, etc.)As mentioned above, shorting a stock has the result of increasing the amount of shares that are available for sale. Maybe this is one reason why they had the up tick test, where you could not short a stock if the previous trade price was lower than the one before that. With that removed, a short seller can sell with a low limit and if the trading is thin watch the price of the stock fall as his short sell order is filled with the available buy orders. So a person who does not even own the stock can negatively effect the price.

A result of short sales is an increase in the supply of shares available to be sold at every price level (up and down) and reducing the pressure on the stock price to rise in order to meet a demand for the shares, even if all the stockholders have no intention of selling, since others are willing to take your shares and sell them (for you.) It is almost if the system is stacked to the side of selling.

Now imagine the increase in the available pool of shares when brokers start selling shares without borrowing them. For example, let’s say that none of a company's stockholders are interested in selling their stock and none are available to borrow to short, but a broker has a client (if not himself) who is just dying to short it. This brings us to the practice/abuse of ‘naked shorting.’

Naked shorting is when a stock is sold short but the ‘borrowed share’ is never delivered three days later at settlement time. Essentially, the broker sold the share without ever buying or borrowing it.In the U.S., in order to sell stocks short, the seller must arrange for a broker-dealer to confirm that it is able to make delivery of the shorted securities. This is referred to as a "locate", and it is a legal requirement that U.S. regulated broker-dealers not permit their customers to short securities without first obtaining a locate. Brokers have a variety of means to borrow stocks in order to facilitate locates and make good delivery of the shorted security. The vast majority of stocks borrowed by U.S. brokers come from loans made by the leading custody banks and fund management companies (see list below). Sometimes, brokers are able to borrow stocks from their customers who own "long" positions. In these cases, if the customer has fully paid for the long position, the broker can not borrow the security without the express permission of the customer, and the broker must provide the customer with collateral and pay a fee to the customer. In cases where the customer has not fully paid for the long position (meaning, the customer borrowed money from the broker in order to finance the purchase of the security), the broker will not need to inform the customer that the long position is being used to effect delivery of another client's short sale. - Wikipedia

This is not an acceptable way to run a market. Not only that but the “locating” of these shares is deceptive. Take a look at how the regulators define locating stock to short:

Question 4.1: How should broker-dealers determine “reasonableness” to satisfy the locate requirement of Regulation SHO?Answer: Rule 203(b)(1)(ii) permits a broker or dealer to accept a short sale order in an equity security if the broker-dealer has reasonable grounds to believe that the security can be borrowed so that it can be delivered on the settlement date. “Reasonableness” is determined based on the facts and circumstances of the particular transaction. What is reasonable in one context may not be reasonable in another context. The Commission provided some examples of reasonableness in the Adopting Release. (69 FR at 48014 and Footnotes 58, 61 and 62).

Why on earth is the settlement day for trades still three days later when we have electronic trading? How is it possible for a broker to sell shares of a stock that it does not have, without landing in jail? This is criminal behavior. It only the regulations that permit this sort of behavior.

How is it that a broker is permitted to sell short shares if he has a reasonable certainty that he will be able to locate shares to borrow? How is it that I cannot buy actual shares unless they are sure I have the funds in my account before I even place the order, let alone let me provide funds on the settlement date. (Or simply buy stocks at whatever price without worrying about paying for them!) The rules on shorting should be simple; you cannot short a stock unless you have the borrowed shares in-hand.

How is it that a broker is permitted to sell short shares if he has a reasonable certainty that he will be able to locate shares to borrow? How is it that I cannot buy actual shares unless they are sure I have the funds in my account before I even place the order, let alone let me provide funds on the settlement date. (Or simply buy stocks at whatever price without worrying about paying for them!) The rules on shorting should be simple; you cannot short a stock unless you have the borrowed shares in-hand.

Better yet, they should do away with short selling of stock. If you want to sell a stock, you should buy it first!

--------------------

These naked shorting phantom shares will produce a fail to deliver on settlement date of the trade since there were not actual shares behind the trade. It is assumed that when there is a fail to deliver, that it is often a short sale that is involved. However, I would think that just as often it is a person who sold a stock held in a margin account whose shares were borrowed and the broker did not replace them when sold. I wonder how often that is the reason for a fail to deliver?

Previous:

Are Brokers 'Screwing' Stockholders through Short Selling? - 6 Apr 06

No comments:

Post a Comment