So on the way home Tuesday evening I caught a couple minutes of Congress debating how to, and how not to cut Government spending. Lucky me caught

Boston Congressman Stephen Lynch's attempt to redefine Republican efforts to cut spending while at the same time not raise taxes against the rich as 'Reverse Robin Hood'. You can catch his comments here

(Clicking the image will take you to the CSPAN site where his comments start a couple seconds into the video):

I have a couple major issues with his line of thinking.

FIRST, in the case of 'Robin Hood', he was stealing from the rich to give back money that was taken by the Government from the poor. In our present society, the bottom half of income earners currently pay no taxes. In effect the Government is asking/taking nothing from them in the form of contribution as part of a collective payment towards the costs of our society. So what Congressman Lynch is defining as taking from the poor, is in actuality proposals to give less to the poor. There is a huge difference.

Second, he attempts to portray Republicans as evil because he claims that Government giving to the poor could somehow continue if only the Republicans would be big enough to raise taxes on the rich or in his words to ask millionaires 'to give a little more'. This is ridiculous for a number of reasons:

- While he is saying millionaires, he then goes on to talk about raising taxes on those earning $250,000 and more. The last time I checked, that was much less than a million, unless he is inferring that people earning such amounts are already millionaires.

- The potential increase in Government revenue by letting the Bush tax cuts expire for the richest Americans is nowhere enough to reduce the yearly Government spending deficits. In fact the cost to extend the tax cuts for the richest for ten years is less than this year's deficit (Previous post pointing this out).

- The Top Federal income tax rate would have gone up to 39.5%. That is like working two days a week just to cover Federal Income taxes, once getting to that rate. Then tack on more work time to cover state and local taxes, before taking care of one's own needs.

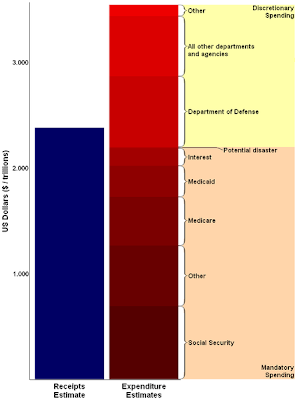

- The President's proposed 2012 budget plans to spend the equivalent of $12,000 per American. So, for my family of 4, the Government will spend $48,000. That is much more than what many families pay in taxes. And there is the reason why the Government has to borrow so much.

Congressman Lynch asks what about the single mother's and those in need? They are good questions, but there are other good questions that he and his Democrat buddies never bother to ask, such as

- What about all the other assistance these people seeking aid already receive?

- Who is working to help those receiving public assistance make their money go father?

As for the single mothers, how about demanding their respective single fathers pitch in? After all, if it is expected that I and other wage earners are expected to substantially support a good percentage of the population, then perhaps we should have a say on how these people are living their lives?

Before you declare this an unreasonable demand, look at how often aid money is wasted and abused. Remember the news of how Katrina aid given to evacuees was used in all sorts of wasteful ways, and now the

Drudge Report is highlighting a Colorado

Bill that would Ban the use of welfare cards at Strip Club ATMs. California has also be fighting abuse of their welfare funds. When is this all going to stop? The rest of us have to adjust to the current reality, so should the poor.

As for the elderly, I do have sympathies, but now I am starting to wonder about their innocence in all of this. They are the ones who elected the politicians who promised them the social welfare whose cost is now threatening to crush the system. They are the ones who permitted the Government to run deficits year after year for most of their lives. Social Security and Medicare entitlements are going to have to be adjusted. It is just a simple reality and

given how people are living much longer, it is a fair adjustment to raise the retirement age, for starters.

Third, given that EVEN IF the Government raised taxes substantially, the budget will still spend more than it takes in in revenue, benefits are going to be cut. So Just who is robbing from who?

Decades of deficits have resulted in a mountain of debt. If Anything, the group that is being robbed is not the poor, but the children of this country. So as Representative Lynch would like to call out that Tea Party supporters are throwing the elderly into the harbor, what he is calling for is for all of us to saddle my generation and my children's generation with their irresponsible spending including their

cleaning out of the Social Security Trust fund.

Now you would think that the poor would be concerned about their children having to pay for the support that they are receiving. However, given that they were never asked to pay for the benefits their parents received, why should they consider anything other than the possibility of the Government cutting back the benefits (and in many cases free lunches) that they are receiving.

Another Point. The Federal Government is not the only Government around. States are also responsible for providing public services, such as fire, police and education. If the people of a state want more, they they should be asked to pay more. This is not happening, partly because the Federal government has been footing the bill. For example, why is the Federal Government sending aid to Alaska while at the same time the State collects no income tax? Who considers this fair.

There is much more to this issue. Again last night I heard another Congressman use the Reverse Robin Hood comment. And I suspect that she will not be the last.

--------------------

--------------------

--------------------