Seems that President Obama has set his sights on letting the Bush tax cuts expire for the richest Americans at the end of the year. This move is purely designed to both punish the richest Americans as well as a political move for the next election to show his core voters (Other than those rich idiots who voted for him) that he is doing his best to 'stick it' to the group of American who already pay the most taxes. They claim that the rich need to pay more because otherwise the deficit will continue to grow.

The reason why I call BS on this is that reinstating the Bush Tax Cuts will do absolutely nothing to reduce the deficit. Take the following story found on the Huffington post noting that the cost to the Government to keep the Bush Tax cuts for the next ten years is between $2.5 and $2.9 Trillion. That is about $250 billion a year.

The reason why I call BS on this is that reinstating the Bush Tax Cuts will do absolutely nothing to reduce the deficit. Take the following story found on the Huffington post noting that the cost to the Government to keep the Bush Tax cuts for the next ten years is between $2.5 and $2.9 Trillion. That is about $250 billion a year.

President Barack Obama favors making the cuts permanent for middle class families, those individuals making more than $200,000 and couples making more than $250,000.The Tax Policy Center, a Washington think tank, estimates it would cost $2.9 trillion over the next decade to extend all the tax cuts, while Obama's plan is estimated at $2.5 trillion over 10 years. - Huffington Post

Now take the following recent news noting that President Obama's Administration has managed to add over $2.5 trillion to the national debt in just 19 months in office.

(CNSNews.com) - In the first 19 months of the Obama administration, the federal debt held by the public increased by $2.5260 trillion, which is more than the cumulative total of the national debt held by the public that was amassed by all U.S. presidents from George Washington through Ronald Reagan. - CNS News

Given the numbers above, any politician who claims that we have to end the Bush tax cuts for the sake of the national deficit should be run out of office. These idiots in power will just use the addition revenue as a reason to spend twice as much.

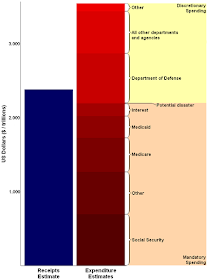

Take a look at this graph (from Wikipedia) noting the difference between what the Government is taking in and what it is spending.

The problem is not revenue collection. It is spending. The amount of additional revenue by expiring the tax cuts for the richest would not be enough to cover Medicare spending in the graph above. And as you can see, it is a mere sliver of the additonal revenue needed to close the gap.

The problem is not revenue collection. It is spending. The amount of additional revenue by expiring the tax cuts for the richest would not be enough to cover Medicare spending in the graph above. And as you can see, it is a mere sliver of the additonal revenue needed to close the gap.And for all these people out there saying that it is OK for people earning more than you to pay more taxes, keep in mind that they already pay more.

Also, as noted in my post 'Obama's 2010 Budget Spends Almost $12,000 Per American!' the level of Government spending is not only unsustainable, it is truly an irresponsible amount of spending:

I can't believe that there is any excuse to continue spending like this. None.Now comes the President's 2010 budget that is also screaming that this is something the Country can't afford.After taking office in January, Obama released a bare-bones version of his budget in February that offered a spending plan for 2010 carrying a price tag of $3.55 trillion. The White House revised up the size of the spending plan to $3.59 trillion. - Yahoo NewsAt $3.59 Trillion, the Government will be spending around $11,970 per American (Given 300 million Americans). That comes out to Government spending of $47,900 for a family of four.

This is an impossible spending figure for the country to sustain. Hell, it will take years, most likely decades of taxation just to pay this one year's deficit back. - Link

The rich should pay at least what I pay. Capital gains should be treated as income. It is income. The fact that Warren Buffet pays less tax asa a percentage if his income than his secretary is outrageous and will lead to a two-tiered society. It's alreay happening. The richest Americans income has gone up by approximately 200% since 1980, while most Americans have barely seen thier incomes increase. Are we to feel sorry for the rich? Give me a reason.

ReplyDeleteDear Anonymous,

ReplyDeleteThe Rich pay much more than you do.

Warren Buffet was an ass to make the analogy that he 'pays less' than his secretary. He was comparing different kinds of income, not taking into account that much of his income was already taxed by his corporations as profit. So his income is in effect double taxed.

Be careful about looking at percentages like Buffet. How would you like it if we made things more fair with a flat tax? the bottom half of tax payers pay nothing or next to nothing. How fair is that?